It’s no surprise that index funds are becoming increasingly popular among investors. After all, these funds offer an easy, low-cost way to invest in the stock market. With index funds, you can buy into a fund that tracks a market index, such as the S&P 500, which gives you exposure to a broad range of stocks in one fell swoop. This can help reduce risk, as the performance of the fund is based on the performance of the underlying index.

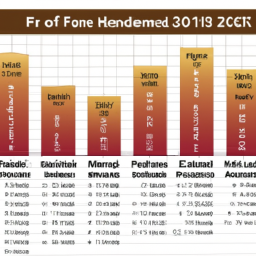

Morningstar recently released their list of the best index mutual funds and exchange-traded funds (ETFs) in 2023. On the list are both U.S. stock index funds and international equity funds. Here’s a look at some of the top funds.

Fidelity 500 Index Fund (FXAIX)

This fund is designed to track the S&P 500 index, which is made up of the 500 largest and most influential American businesses. The top 10 holdings in the fund account for around 28% of the fund’s assets. FXAIX has an expense ratio of 0.035%, and its performance in 2023 has been strong. The only downside is that this fund lacks international equity exposure.

Vanguard 500 Index Fund (AMEX:VOO)

This is another fund that tracks the S&P 500 index. It has an expense ratio of 0.03%, and its performance in 2023 has been solid. VOO’s top 10 holdings make up around 26% of the fund’s assets.

Vanguard Small-Cap Index Fund (AMEX:VB)

This fund is designed to track the performance of small-cap stocks. The fund has an expense ratio of 0.05%, and its performance in 2023 has been strong. VB’s top 10 holdings make up around 26% of the fund’s assets.

Vanguard Total Stock Market Index Fund (VTSMX)

This fund is designed to track the performance of the entire U.S. stock market. It has an expense ratio of 0.04%, and its performance in 2023 has been solid. VTSMX’s top 10 holdings make up around 25% of the fund’s assets.

Vanguard Total International Stock Index Fund (VGTSX)

This fund is designed to track the performance of stocks from developed and emerging markets outside of the U.S. It has an expense ratio of 0.11%, and its performance in 2023 has been strong. VGTSX’s top 10 holdings make up around 16% of the fund’s assets.

The Select Sector SPDR Fund

This fund is designed to track the performance of a specific sector of the stock market. The fund has an expense ratio of 0.10%, and its performance in 2023 has been strong. The fund’s top 10 holdings make up around 17% of the fund’s assets.

Vanguard Total Bond Market Index Fund (VBMFX)

This fund is designed to track the performance of the entire U.S. bond market. It has an expense ratio of 0.05%, and its performance in 2023 has been solid. VBMFX’s top 10 holdings make up around 20% of the fund’s assets.

Vanguard REIT Index Fund (AMEX:VNQ)

This fund is designed to track the performance of the real estate market. It has an expense ratio of 0.07%, and its performance in 2023 has been strong. VNQ’s top 10 holdings make up around 25% of the fund’s assets.

Overall, these are some of the best index mutual funds and exchange-traded funds of 2023. Each of these funds has its own strengths and weaknesses, so it’s important to carefully consider your investment goals before deciding on a fund.