Lockheed Martin (NYSE:LMT) reported earnings 30 days ago, and investors are wondering what's next for the stock. We take a look at earnings estimates for some clues. Lockheed Martin is a global security and aerospace company that specializes in the design, manufacture and integrated systems for the defense, space, and intelligence sectors. The company is the largest defense contractor in the world and is a major player in the aerospace industry.

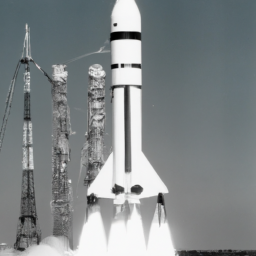

United Launch Alliance (ULA) had been aiming to blast off Vulcan Centaur vehicle in first quarter of this year. The launch of the Vulcan Centaur is a major success for Lockheed Martin, as it marks the first successful launch of a new rocket in a relatively short amount of time. The launch of the Vulcan Centaur also marks a significant milestone in the company's ongoing efforts to develop next-generation launch vehicles.

IDEX, the International Defense Exposition held every other year in Abu Dhabi, is one of the few remaining places in the world where defense contractors can showcase their latest products. At the event, Lockheed Martin demonstrated their latest technologies and systems, including their F-35 Joint Strike Fighter and C-130J Super Hercules. The company also showcased their newly-developed hypersonic missiles and their new space systems.

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Lockheed Martin Corporation (NYSE:LMT) has recently announced a dividend increase. The company has announced that its quarterly dividend will be increased from $1.60 per share to $2.00 per share, an increase of 25%. This increase in the dividend payment is a clear sign that the company is confident in its future prospects and is committed to rewarding its shareholders.

China has imposed sanctions on two American defense manufacturers over arms sales to Taiwan, a day after Beijing pledged to take “reciprocal measures” against companies that supply weapons to the island. The two companies affected are Lockheed Martin and Raytheon Technologies. China on Thursday put Lockheed Martin and a unit of Raytheon Technologies on an 'unreliable entities list' over arms sales to Taiwan, and imposed trade and investment sanctions on the two companies.

This article gives you three dividend stocks to buy that offer the opportunity for dividend growth and some stock price growth as well. One of these stocks is Lockheed Martin (NYSE:LMT), which has a current dividend yield of 1.9%. The company has a strong history of dividend payments and has increased its dividend payment for the past seven years. In addition, the company has a healthy balance sheet and a solid return on equity.

China is sanctioning Lockheed Martin and Raytheon Technologies over military sales to Taiwan as Beijing remains engaged in a territorial dispute with the self-governing island. The Chinese government announced that it would place both companies on an “unreliable entities list” and impose trade and investment sanctions on them. The move comes after the U.S. approved a $1.8 billion arms sale to Taiwan, which is considered by the Chinese government to be a breakaway province.

BEIJING (AP) — China imposed trade and investment sanctions Thursday on Lockheed Martin and a unit of Raytheon for supplying weapons to Taiwan. In a statement, the government said the companies had been added to an "unreliable entities list" and would be subject to unspecified restrictions. The move is part of a series of retaliatory measures by China against the U.S. for its support of Taiwan, which Beijing considers a breakaway province.