Investing.com -- It's set to be a much quieter week on the economic calendar, but there's still plenty for markets to mull over after last week's stellar performance. This week will bring a slew of earnings reports; however, the economic data schedule is rather sparse. Investors will be looking to the corporate earnings reports to direct the markets, while keeping an eye out for any potential surprises that could impact the market.

The first big event of the week will be the release of the U.S. Treasury's budget statement on Monday. The statement is expected to show an increase in deficit spending, as the government continues to pump money into the economy to stimulate growth. The release of the budget statement could help to set the tone for the markets for the rest of the week, so Investors should pay close attention.

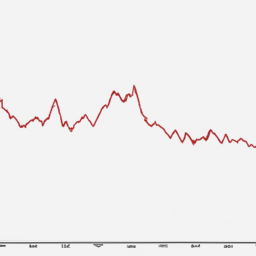

On Tuesday, Investors will be keeping an eye on the release of the U.S. Consumer Price Index (CPI). This index is used to measure inflation and is an important metric for the markets. A higher than expected CPI reading could signal a potential increase in inflation, which could affect the markets.