If you're looking to grow your investments, one of the smartest strategies you can take is to utilize the power of compound interest. Compound interest is the interest on savings calculated on both the initial principal and the accumulated interest from previous periods. This means that the more you invest and the longer you keep your money in the account, the more your money will grow over time.

To help you understand how your investments can grow with compound interest, there are several investment growth calculators available online. One such calculator is NerdWallet's compound interest calculator. Here's how to use it:

- Go to NerdWallet's compound interest calculator

- Enter your initial deposit amount

- Enter your monthly contribution amount (if applicable)

- Enter your expected interest rate

- Enter the number of years you plan to keep your money invested Once you've entered all of the necessary information, the calculator will show you how much your money can grow with compound interest. You can also adjust the interest rate and investment time frame to see how these factors can impact your investment growth.

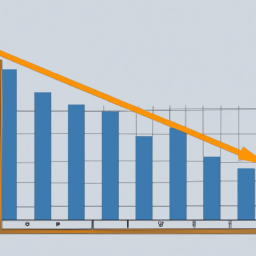

Another popular investment growth calculator is MarketBeat's free investment calculator. This calculator allows you to estimate how much your investments may grow based on your initial deposit, planned contributions, expected rate of return, and investment time frame. It also provides a chart showing the growth of your investments over time.