Dividends are periodic payments made by a company to its shareholders out of its profits. Dividends are paid on a per-share basis, meaning that the amount paid per share is proportional to the number of shares owned by the shareholder. Dividends can be paid in cash, stock, or other property, and are typically paid quarterly.

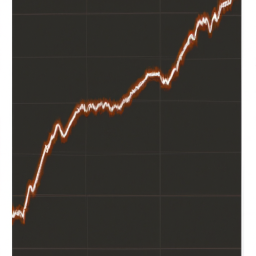

Dividend investing can be a great investment strategy. Dividend stocks have historically outperformed the S&P 500 with less volatility. This is because dividend-paying companies tend to be more stable and profitable than companies that don't pay dividends. Additionally, dividend-paying companies are often more mature and established, which makes them less risky than newer companies.

There are two main types of dividends: cash dividends and stock dividends. Cash dividends are the most common type of dividend. They are paid in cash to shareholders on a per-share basis. Stock dividends, also known as bonus shares, are paid in the form of additional shares of stock.

Dividend investing is a great way to ensure a steady stream of income from your investment portfolio. Dividend-bearing assets pay you on a regular basis, which can help you to maintain your lifestyle and cover your expenses. Additionally, dividend-paying stocks can help to offset the effects of inflation by providing a higher yield than other types of investments.

Treasury stock is previously outstanding stock bought back from stockholders by the issuing company. The company can buy back its own shares for a variety of reasons, such as to increase the value of the remaining shares, to reduce the number of outstanding shares, or to have shares available for employee stock options.

New York-listed Genco Shipping & Trading has expressed a strong commitment to keep its quarterly dividend alive even in weaker conditions, which is a positive sign for investors who are looking for stable dividend-paying stocks. This commitment shows that the company is confident in its ability to generate profits and maintain its financial health.

Qualified dividends are dividend payments that are taxed at long-term capital gains tax rates for stocks held for a certain amount of time. This means that qualified dividends are taxed at a lower rate than ordinary income, which makes them a more attractive investment for many investors.

Companies that increased dividends every year for at least the last 25 years in the S&P 500 index are dividend aristocrats. These companies have a proven track record of consistently increasing their dividends, which makes them a popular choice for dividend investors.

Learn how dividends work, how they're calculated and processed, and when and how companies pay their shareholders. Understanding the mechanics of dividends can help you to make better investment decisions and maximize your returns.

Preferred stock refers to a class of ownership that has a higher claim on assets and earnings than common stock has. Preferred stock typically pays a fixed dividend, which makes it a popular choice for income investors. However, preferred stockholders do not have voting rights, which means that they have less control over the company's operations than common stockholders.

Overall, dividend investing can be a great way to generate income and build wealth over the long term. By investing in dividend-paying stocks, you can benefit from stable and reliable returns, as well as the potential for capital gains. Whether you're a seasoned investor or just starting out, dividend investing is a smart strategy to consider.