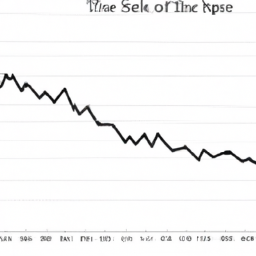

The stock market is a fickle beast that is constantly changing based on various economic indicators. One such indicator is the S&P 500, which is an index of the top 500 companies in the US market. This index is often used as a benchmark for the overall health of the stock market. However, recent predictions suggest that the S&P 500 may be facing rough times ahead.

"I think it's inevitable, given what the indicators are doing, that we're going to have a pretty rough recession," says Jon Wolfenbarger. He predicts the index could fall more than 10% from Thursday's close. This prediction is based on a number of factors, including the ongoing pandemic, global economic instability, and political uncertainty.

Despite these potential challenges, there are still certain stocks that remain in focus this week. S&P 500 stock DexCom (NASDAQ:DXCM) along with New Relic (NYSE:NEWR), Flywire (NASDAQ:FLYW), ASML (NASDAQ:ASML) and Kinsale Capital (NYSE:KNSL) are all worth keeping an eye on. These companies have demonstrated solid performance in recent weeks and may continue to do so.

Of course, not all stocks are created equal. A stock is considered overbought if its 14-day RSI goes above 70, signaling investors should consider easing their exposure. This is important to keep in mind when considering potential investments.

Recent market activity has been somewhat mixed. On May 11 (Reuters) - The Dow and the S&P 500 ended lower on Thursday, dragged down by Walt Disney Co (DIS.N) as it lost subscribers. This loss was partially offset by gains in the tech sector. However, the Dow and the S&P 500 opened lower on Thursday, pressured by a drop in Disney shares after the company reported a fall in subscriber numbers. The Dow and the S&P 500 were set to open lower on Thursday, pressured by a drop in Disney shares after the company reported a fall in subscribers. These fluctuations serve as a reminder of the volatility of the stock market.

It takes a certain type of investor to swim against the current of Wall Street's consensus view. Some investors, however, relish being contrarian and seek out opportunities that others may overlook. These investors may be well-suited to weather potential market downturns and capitalize on overlooked opportunities.

Looking back over the history of the S&P 500, there have been an extraordinary range of outcomes since its inception in 1928. This serves as a reminder that the stock market is unpredictable and that past performance is not necessarily indicative of future results.

Overall, it seems that the S&P 500 may be facing some challenges in the coming months. However, there are still certain stocks worth keeping an eye on. Investors should remain cautious and mindful of potential risks, but should also be open to opportunities that may present themselves.