An ETF, or exchange-traded fund, is a type of investment that you buy and sell through a stock exchange or investment company. Essentially, an ETF is a specialized investment company that manages a portfolio of stocks, bonds, real estate, or other types. ETFs are similar to mutual funds in that they offer investors a way to diversify their portfolio, but they differ in how they are traded and their fees.

ETFs are traded on an exchange like stocks, meaning you can buy and sell them throughout the day at market prices. In contrast, mutual funds are priced at the end of the trading day, and investors buy or sell them at the net asset value (NAV) price. ETFs also tend to have lower expense ratios than mutual funds, making them a more cost-effective investment option.

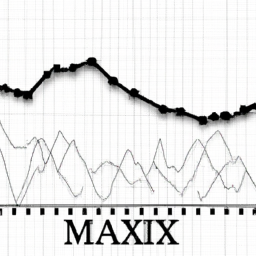

One of the benefits of ETFs is that they allow investors to gain exposure to a wide range of stocks or other securities with a single investment. For example, the SPDR S&P 500 ETF (AMEX:SPY) tracks the performance of the S&P 500 index, giving investors exposure to the 500 largest publicly traded companies in the US. Other popular ETFs include the Vanguard Total Stock Market ETF (AMEX:VTI), which tracks the performance of the entire US stock market, and the iShares MSCI EAFE ETF (AMEX:EFA), which tracks international stocks in developed markets.

ETFs can be classified into different categories based on the types of securities they hold. For example, equity ETFs hold stocks, bond ETFs hold bonds, and commodity ETFs hold commodities like gold or oil. Within these categories, there are also sector-specific ETFs that focus on industries like technology, healthcare, or energy.

The last 18 months have been challenging for "growth" companies – businesses that are expected to outrun the stock market in terms of share price appreciation. As a result, many investors have turned to value ETFs, which hold stocks that are considered undervalued by the market. Value ETFs can provide a way to invest in companies with strong fundamentals that are trading at a discount.

Another advantage of ETFs is their tax efficiency. Because they are structured differently from mutual funds, ETFs are generally more tax-efficient. When investors redeem shares of a mutual fund, the fund may have to sell securities to raise cash, triggering capital gains taxes. In contrast, ETFs can be redeemed for a basket of securities, allowing investors to avoid triggering capital gains taxes.

ETFs vs mutual funds is a common debate in the investment world. While ETFs offer many benefits over mutual funds, they may not be the best option for every investor. Some investors prefer mutual funds because they can be easier to manage, with automatic investment options and dividend reinvestment. Additionally, some mutual funds offer lower expense ratios than ETFs, especially for small investors.

Exchange-traded funds (ETFs) track financial securities and can diversify your portfolio basket when you trade or invest in the markets. ETFs are popular because they offer investors a way to invest in a diversified basket of securities with a single investment. They are also more tax-efficient than mutual funds and can be traded throughout the day like stocks.

ETFs are not without risks, however. Like any investment, they can lose value, and investors can lose money if they sell at a loss. Additionally, some ETFs are more complex than others, and investors should carefully read the prospectus and understand the underlying securities before investing.

In conclusion, exchange-traded funds (ETFs) have become a popular and important investment product since they were first created in the 1990s. They offer investors a way to diversify their portfolio with a single investment, and they are traded throughout the day like stocks. Some of the top stock ETFs include the SPDR and Vanguard 500, as well as other sector-specific and international ETFs. While ETFs offer many benefits over mutual funds, investors should carefully consider their investment goals and risk tolerance before investing in any ETF.