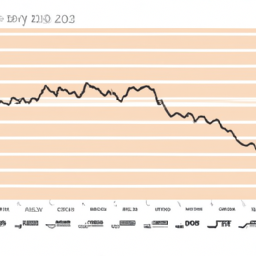

Last year was an extraordinary one for the bond market, and not in a good way. The Bloomberg U.S. Aggregate Bond Index - a proxy for the entire U.S. bond market - fell 2.2% in 2022, marking the first annual decline since 2013. This came as a shock to many investors who had relied on bonds as a safe haven asset. However, some experts believe that bonds may still be a good investment option in 2023.

Investors searching for good news have certainly found some: The latest consumer price index report suggested inflation may have peaked in 2022. This is good news for bond investors, as higher inflation erodes the purchasing power of fixed-income securities. With inflation potentially under control, bond investors may be able to expect better returns in 2023.

If you're looking to grow your wealth through investing, you can opt for lower-risk investments that pay a modest return, or you can take on more risk for the potential of higher returns. Bonds are often seen as a lower-risk investment option, as they provide a steady stream of income and are generally less volatile than stocks. However, it's important to note that not all bonds are created equal.

When you invest in a total bond market index fund, you are adding exposure to the entire U.S. bond market to your portfolio. This can provide diversification and help mitigate risk. However, it's important to do your research and understand the types of bonds included in the index fund you choose.

Historically, bonds have always acted as a kind of ballast for portfolios. During market crashes like those in 2008 and March 2020, bonds, particularly U.S. Treasury bonds, have tended to perform well as investors seek safe haven assets. This means that even in turbulent times, bond investments can help to balance out the overall risk of your portfolio.

2022 was a remarkable year for financial markets. The fact that stocks experienced a bear market wasn't all that unusual, even coming on the heels of a decade-long bull market. However, what made 2022 unique was the fact that bonds, which are often seen as a safe haven asset, also saw a decline. This has left many investors wondering if they should stick with bonds in 2023.

After investors suffered their worst losses ever in 2022, bond returns are poised to rebound next year. High yields, falling inflation, and rising recession risk have prompted heavy buying after record fund outflows in 2022. This means that bond investors may be able to expect better returns in 2023.

October capped their worst 12-month period ever, and the economy is under pressure. Yet the fundamental math of bond returns bodes well for investors. While the returns on bonds may not be as high as those on stocks, the steady stream of income they provide can help to balance out the overall risk of your portfolio.

Overall, bonds may still be a good investment option in 2023, particularly for investors seeking a lower-risk investment option. However, it's important to do your research and understand the types of bonds included in any index funds you choose. With inflation potentially under control and bond returns poised to rebound, now may be a good time to consider adding bonds to your portfolio.