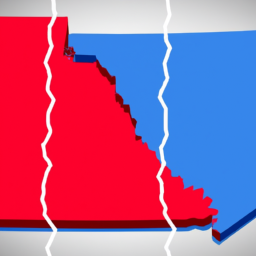

The fight against ESG (Environmental, Social and Governance) investing at firms like BlackRock has become an increasingly politicized issue, as policymakers and investors are being forced to grapple with the red state-blue state divide over a framework intended to manage risk and promote sustainable practices. With ESG assets expected to top $33 trillion by 2026, the battle over this investing approach—which takes into account social and environmental issues—is heating up in Congress.

On one side, those in favor of ESG investing argue that it promotes sustainable practices and offers investors reliable data on company performance around certain topics. On the other side, many Republicans argue that ESG investing undermines key protections and has become a vehicle for politically inappropriate and financially irresponsible investing.

The debate over ESG investing has become increasingly partisan in recent years, with many Republicans viewing the framework as a means of pushing left-leaning policies. This has been most evident in the battle that has played out in statehouses across the country, as lawmakers have passed laws targeting banks and their climate policies.

The growing divide has been reflected in a letter sent to Congress by more than 100 conservative groups, which urged legislators to roll back President Biden’s “politically inappropriate” and “financially irresponsible” ESG policies. The letter argues that by requiring firms to adhere to ESG standards, the Biden administration is stifling investors’ ability to make sound financial decisions.

The debate over ESG investing has also been complicated by a series of laws filed by bankers in Kentucky, who claim that the state’s new law targeting banks and their climate policies is unconstitutional. The laws pits the state’s definition of investment risk against the bankers’, with both sides debating the merits of ESG investing and the role of government in promoting sustainable practices.

The debate over ESG investing has also been complicated by the fact that it seemed for the longest time that investments in this area were becoming increasingly fragile due to questionable profitability. But the recent surge in ESG investing suggests that the framework is becoming more popular with investors, as it is seen as a way to promote sustainable practices and manage risk.

It is clear that the battle over ESG investing is far from over, with Republicans and Democrats debating the merits of the framework and its role in managing risk. Investors will have to decide for themselves whether ESG investing is worth the risk or not, as the debate over this framework continues to rage on in Congress and statehouses across the country.