Investing for beginners can seem daunting, but understanding the basics of asset allocation is the first step in building a solid portfolio. All investors should understand the four core asset classes and how they can use them to their advantage. Understanding the core asset classes is the first step to building an effective portfolio.

The four core asset classes are stocks, bonds, cash, and alternatives. stocks represent ownership of a company and have the potential for higher returns, but also come with greater risk. bonds are loans to companies and government entities, and generally offer more stability and less volatility than stocks. Cash investments such as money market accounts, CDs, and Treasury bills provide liquidity and stability, but with lower returns. Alternatives such as real estate, gold, and cryptocurrencies offer greater returns, but come with greater risk and less liquidity.

When deciding how to allocate your assets, it’s important to consider your risk tolerance. Depending on your risk tolerance, you may choose to invest in a mix of the four core asset classes. For example, a beginner with a low-risk tolerance may want to invest in large cap stocks after studying the company’s financials, including its earnings, balance sheet, and cash flow. An invest with a higher risk tolerance may choose to invest in smaller, risk stocks or alternative assets such as real estate and gold.

It’s also important to consider how much money you should invest. Beginners should set achievable goals and then plan to invest in a scheme that will help them reach those goals. Additionally, it’s important to consider your risk tolerance and financial goals when deciding how much money to invest. If you’re a beginner, it’s best to start small and build your portfolio over time.

Another important consideration is diversification. Diversifying your investments is key to spreading out your risk and maximizing returns. One way to diversify your investments is to create a portfolio with a mix of stocks and bonds. This is because while stocks offer greater growth, bonds can help lessen their volatility.

Creating a portfolio of stocks and bonds is relatively easy. One way to do this is to create a 60/40 portfolio, which consists of 60% stocks and 40% bonds. This portfolio will offer more growth potential than a portfolio of only bonds, but will also be less volatile than a portfolio of only stocks.

For those looking for more exotic investments, property investments may be an option. Property investments can be a lucrative business, but it is important to understand the markets and the risk involved. Investing in property can be a great way to diversify your portfolio, but it’s important to do your research and understand the potential risk.

Another option for those looking for a more exotic invest is silver. Investing in silver can be a great way to diversify your portfolio and gain exposure to a precious metal. silver is a stable asset and is often seen as a safe-haven asset during times of economic uncertainty.

Investing in silver can be done through a number of different vehicles, such as coins and bars. It’s important to do your research and understand the risk involved before Investing in silver. Additionally, it’s important to understand the tax implications of Investing in silver, as it can be subject to capital gains taxes.

Investing for beginners can be intimidating, but understanding the basics of asset allocation is the first step in building a solid portfolio. All investors should understand the four core asset classes and how they can use them to their advantage. Additionally, it’s important to consider your risk tolerance and financial goals when deciding how much money to invest.

Creating a diversified portfolio is key to ensuring your investments are spread out and are not overly exposed to any one asset class. Additionally, Diversifying your portfolio will help to minimize your risk and maximize your returns.

It’s important to do your research and understand the risk associated with any invest before you commit your money. Beginners should start small, build their portfolio over time, and diversify their investments to ensure they are not overly exposed to any one asset class.

Investing for beginners can be intimidating, but understanding the basics of asset allocation and doing your research is key to building a secure portfolio. With the right strategy and knowledge, beginners can create a diversified portfolio that will help them reach their financial goals.

The stock market can be a great way to build wealth, but it’s important to understand the risk associated with Investing. Beginners should start small, build their portfolio over time, and diversify their investments to ensure they are not overly exposed to any one asset class. With the right strategy and knowledge, beginners can create a secure portfolio that will help them reach their financial goals.

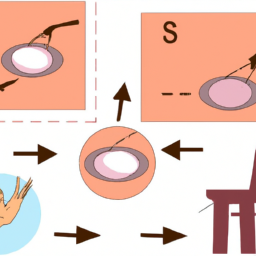

A photo of a person looking at a financial graph with a hand holding a pen, highlighting the importance of financial planning and research when Investing.