The Federal Reserve's recent rapid hiking of interest rates has led to an inversion of the yield curve. This means that short-term debt instruments have higher yields than long-term instruments of the same credit risk profile, which is often seen as a warning sign of an impending recession. Yield curve inversions do not cause a recession, but rather indicate a shift in investor sentiment that could reflect underlying economic trends.

The inversion of the yield curve has caused investor to scrutinize the economic outlook and to reconsider their investment strategy. An inverted yield curve is typically seen as a sign of a less-than-favorable economic outlook, as it indicates that investor are more willing to take on short-term risk for long-term gain. This indicates that investor are expecting future economic growth to slow down and that the long-term investment opportunities may not be as attractive as they once were.

When the yield curve inverts, it usually signals a period of slow economic growth. This is due to the fact that the cost of borrowing is higher for both consumers and businesses, which causes a decrease in consumer spending and investment. This decrease in consumer spending and investment could lead to a decrease in economic growth.

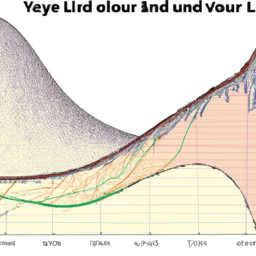

The negative split, which creates inverted yield curves (when short-term yields exceed those of longer-term bonds), supposedly began to take effect in the second quarter of 2019. This week's 500,000 scenario simulation of the US Treasury yield curve showed the market nearing an unwinding of the inverted yield curve. The yield curve extended its record inversion and the bond market's long-time recession indicator has never looked so bad—and it keeps getting worse.

In addition to the yield curve, investor should also pay attention to other economic indicators such as unemployment, consumer spending, and inflation. These indicators can provide more insight into the current economic climate and how it could impact investment.

It is important to note that while yield curve inversions have historically preceded recession, they do not necessarily cause them. Therefore, it is important for investor to remain informed of the current economic climate and to make investment decisions that are best for their individual circumstances.

investor should also remain aware of the potential market risk associated with yield curve inversions. For example, the inverted yield curve could lead to a decrease in stock prices as investor become more risk-averse. Similarly, an inverted yield curve could lead to a decrease in bond prices as investor become more cautious about taking on long-term debt.

Ultimately, the inverted yield curve is a signal of an uncertain economic outlook and investor should be aware of the potential risk associated with their investment. It is important to stay informed of the current economic climate and to make informed investment decisions that are best for the individual's portfolio.