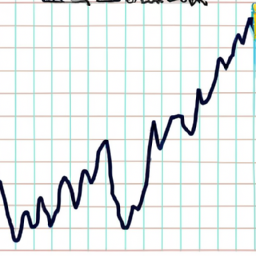

U.S. stock futures were trading lower during Tuesday's evening deals, after major benchmark averages finished the regular trading day at record highs amid hopes for a vaccine-led economic recovery. By Oliver Gray for Investing.com - The Dow Jones Industrial Average futures were down by 0.2%, the S&P 500 futures slipped 0.2%, and the Nasdaq 100 futures were down by 0.4%.

The Dow 30 futures, which track the Dow Jones Industrial Average, are a type of futures contract that allow investors to speculate on the performance of the Dow 30 stock on the next trading day. These contracts are based on the Dow Jones Industrial Average index, which is composed of 30 large-cap U.S. stock.

The Dow 30 futures offer investors the opportunity to bet on the short-term direction of the stock market, and they are heavily traded by both individual and institutional investors. The Dow 30 futures can be used to hedge against short-term market volatility or to speculate on the direction of the stock market.

investors have been attracted to the Dow 30 futures due to their low cost, as well as the potential to gain exposure to the stock market with a small amount of capital. Furthermore, the Dow 30 futures are very liquid and they are easy to trade on a daily basis.

In recent years, the Dow 30 futures have become increasingly popular with investors who are looking for efficient ways to gain exposure to the stock market. The Dow 30 futures offer investors the opportunity to speculate on the direction of the stock market without having to take on the risk associated with owning stock.

The Dow 30 futures are heavily influenced by the underlying stock that make up the index. For instance, the Dow 30 futures will rise and fall in tandem with the Dow Jones Industrial Average. Therefore, investors should pay close attention to the news and events affecting the stock in the index in order to gain an edge in their trading.

In addition to being influenced by the underlying stock, the Dow 30 futures can also be affected by macroeconomic events. For example, the Dow 30 futures will often rise and fall in response to economic data releases, such as GDP and unemployment figures. Furthermore, geopolitical events can also affect the Dow 30 futures, as investors adjust their positions in anticipation of potential political and economic developments.

Overall, the Dow 30 futures offer investors the opportunity to gain exposure to the stock market without having to take on a large amount of risk. Furthermore, the Dow 30 futures can be used to hedge against short-term market volatility or to speculate on the direction of the stock market. It is important for investors to be aware of the factors that can influence the Dow 30 futures in order to be successful in their trading.