What are Mutual Funds and How Do They Work?

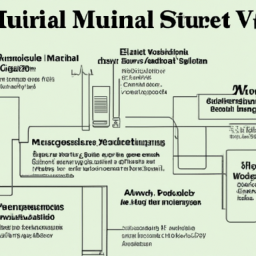

Mutual Funds are investment companies that pool money from many investors and use it to purchase stocks, bonds, and other securities. This type of investment vehicle offers investors the chance to diversify their portfolio and access the stock market without having to make individual investment in individual stocks. Mutual Funds are managed by professional fund managers who use their expertise to pick the most profitable stocks, bonds, and other securities.

The fund manager’s goal is to maximize returns for their investors by picking the most profitable investment and minimizing the amount of risk taken. Mutual Funds can be divided into two main categories: actively managed funds and passively managed funds. Actively managed funds are those that are actively managed by the fund manager and are designed to generate higher returns by actively selecting stocks based on the fund manager’s judgment. Passively managed funds, on the other hand, are designed to track an index, such as the S&P 500, and are designed to generate returns that match the index’s returns.

When investing in Mutual Funds, it is important to understand the fees associated with the fund. Mutual Funds charge fees for management, administrative, and trading costs. These fees can vary significantly from one fund to another, so it is important to understand all of the fees associated with the mutual fund before investing. Additionally, it is important to understand the tax implications of investing in Mutual Funds.

investors can also use Mutual Funds to access the global markets. Many Mutual Funds offer investment in foreign stocks, bonds, and other securities. These investment offer investors the chance to diversify their portfolios and access the global markets without having to purchase individual stocks and bonds in each country. Additionally, many Mutual Funds offer access to alternative investment, such as commodities and real estate. These investment can provide investors with additional diversification and the potential for higher returns.

Using the Zacks Mutual Fund Rank of over 19,000 Mutual Funds, investors can identify three outstanding Mutual Funds that are ideally suited to help them meet their investment goals. Additionally, during the 2007-2009 financial crisis, investors in money market Mutual Funds ‘ran’—cashed in their shares at the same time—to avoid losses.

ETFs and Mutual Funds are both structured as investment vehicles that allow investors to pool their money together to buy a basket of individual stocks and bonds. ETFs trade like stocks, while Mutual Funds are priced once a day, after the market closes. Mutual Funds typically have higher fees than ETFs, but also offer more diversification and the potential for higher returns.

The family of Mutual Funds in China wholly owned by overseas capital has seen significant growth in recent years, driven by foreign financial institutions in China’s Mutual Funds. Additionally, NEW DELHI: Mutual Funds diversify risk but they do not eliminate it. How? Let’s understand this today. So mutual fund invest in securities, and these securities are held by the fund and are not owned by the investors.

Canadian investors should consider these top Mutual Funds for their retirement savings accounts. These funds offer investors the opportunity to access the Canadian markets and diversify their portfolios. Additionally, these funds offer the potential for higher returns, as well as professional fund management.