Bonds are a type of fixed-income investment that can provide a steady stream of income and, in some cases, capital appreciation. They are often seen as a lower-risk alternative to stocks, making them a popular choice for investors who are looking for a more conservative approach to wealth-building.

If you're looking to grow your wealth through investing, you can opt for lower-risk investments that pay a modest return or you can take on more risk for the potential of higher returns. Bonds fall into the former category, offering a reliable way to increase wealth without exposing yourself to the volatility of the stock market.

When you invest in a total bond market index fund, you are adding exposure to the entire U.S. bond market to your portfolio. This can be a smart move for investors who want to diversify their holdings and reduce their overall risk.

Bonds come in many different varieties, including government bonds, corporate bonds, and municipal bonds. Each type of bond has its own unique characteristics, and investors should carefully consider their options before making a purchase.

One of the main benefits of investing in bonds is that they typically offer a fixed rate of return, which makes them a good choice for investors who are looking for a predictable source of income. Additionally, many bonds are tax-exempt, which can help investors keep more of their earnings.

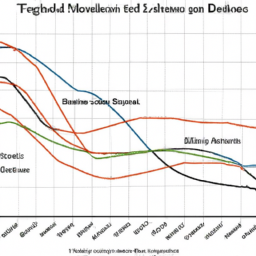

The factors that drove the bond market down in 2022 may be reversing course, investing experts say. This means that now could be a good time to invest in bonds, as prices are expected to rise in the coming months.

Check out these safe investment options if you're risk-averse or looking to protect principal. Bonds are often included on these lists, as they are considered to be one of the safest investments available.

Discover why bonds may be more attractive than U.S. stocks heading into 2023 and how investors can take advantage of new opportunities in the bond market. With interest rates expected to remain low for the foreseeable future, bonds could be a smart choice for investors who are looking for a reliable source of income.

Investors approaching retirement, or who are already retired, should typically look for securities or other products that generate income. Bonds can be an excellent choice for these investors, as they offer a steady stream of income and are generally less volatile than stocks.

If you're interested in investing in bonds, there are a few different ways to get started. One option is to purchase individual bonds directly from the issuer. Another option is to invest in a bond fund, which is a collection of bonds managed by a professional fund manager.

Learning how to buy bonds is an essential part of your education as an investor. A well-diversified portfolio should always strike a balance between stocks and bonds, and investors should carefully consider their options before making a purchase.

Overall, bonds are a lower-risk way to increase your wealth than the stock market. Learn how they work and decide if they are a good fit for your investment strategy. With the right approach, bonds can be an excellent tool for building wealth over the long term.